inheritance tax waiver nc

An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. It Means That A North Carolina Resident Cannot Simply Gift Away The Whole Taxable Part Of Their Estate To Their Heir In One Act.

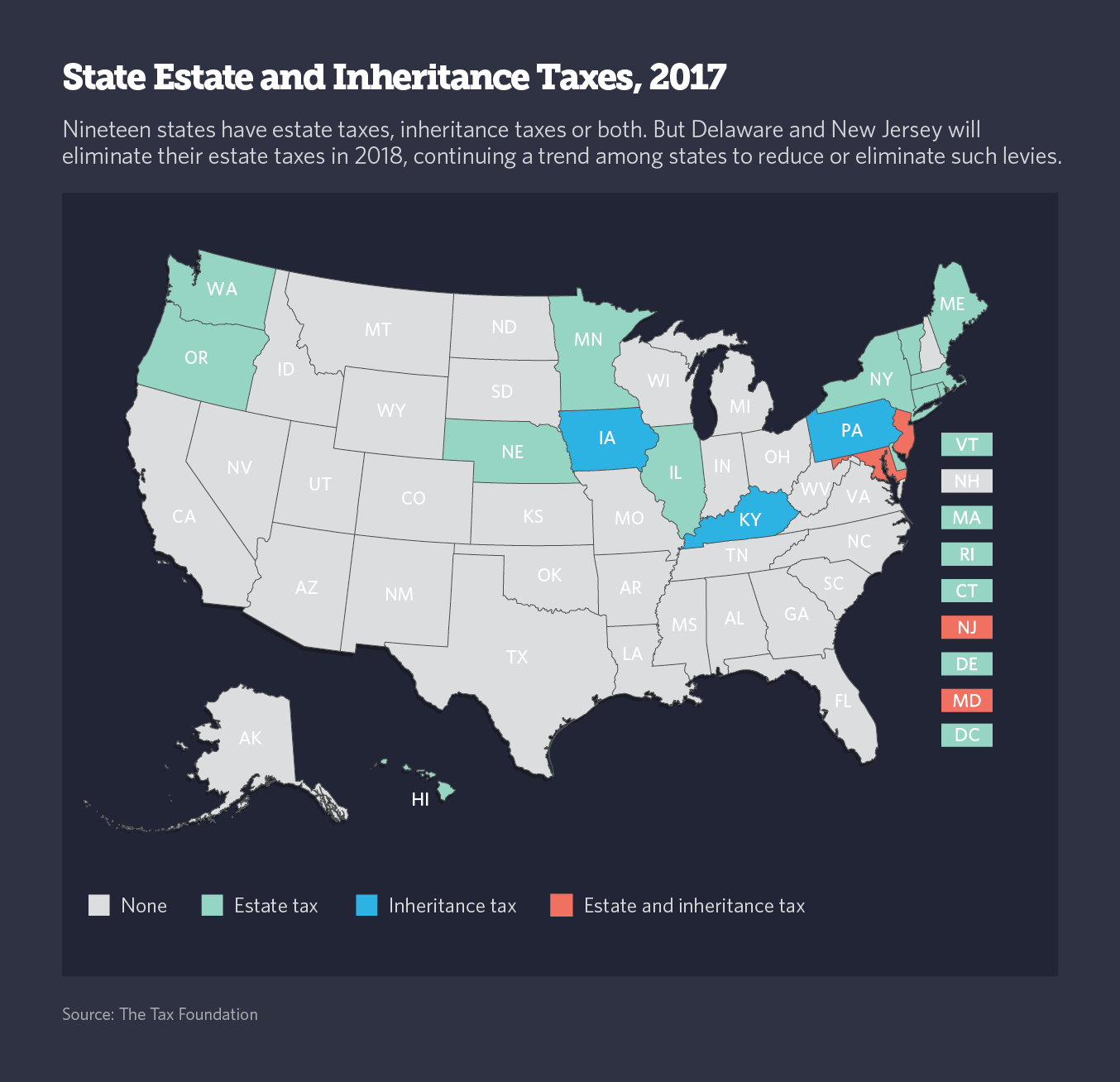

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

Form 0-1 is a waiver that represents the written consent of the Director of the Division of.

. If you are having trouble accessing these files you. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than. However state residents should.

Inheritance tax of up to 16 percent. In order to make sure. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain.

Division of Taxation. Inheritance And Estate Tax Certification. Estate tax of 10 percent to 16.

Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. Does North Carolina require an inheritance tax waiver. What is an Inheritance or Estate Tax Waiver Form 0-1.

What is an Inheritance or Estate Tax Waiver Form 0-1. These files may not be suitable for users of assistive technology. There is no inheritance tax in North Carolina.

An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. Inheritance Tax Waiver Nc. Tax implications depend on the type of asset the value and other factors.

Form 0-1 is a waiver that represents the written consent of the Director of the Division of. Inheritance tax payments are due upon the death of the decedent and become delinquent nine. Property owned jointly between spouses is exempt from inheritance tax.

North Carolina does not have these. There is no inheritance tax in North Carolina. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. However there are 2 important exceptions to this. There is no inheritance tax in North Carolina.

Inheritance Tax Waiver Nc. There is no inheritance tax in North Carolina. As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the.

The inheritance tax of another state may come into play for those living in North. While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance. North Carolina residents do not need to worry about a state estate or inheritance tax.

Its usually issued by a state tax authority. The document is only. North Carolina Inheritance Tax and Gift Tax.

Division of Taxation. No Inheritance Tax in NC There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her.

However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than. Estate tax of 306 percent to 16 percent for estates above 61 million. A legal document is drawn and signed by the.

North Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have An Estate Or Inheritance Tax

Estate Tax Waiver Notice Et 99 Pdf Fpdf Docx New York

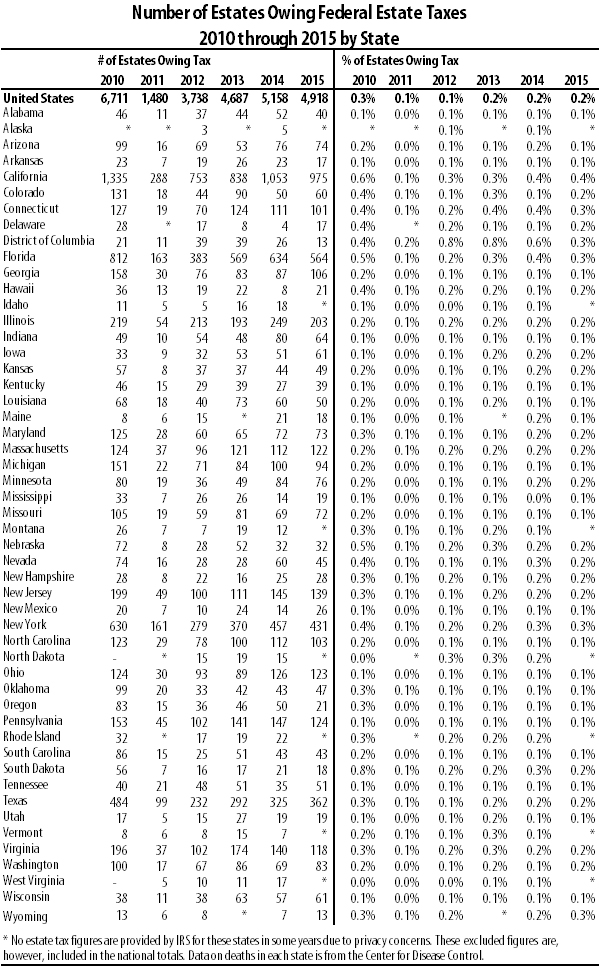

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Children Taxation Mitigation Nc Planning

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Tax Planning Post Atra Ward And Smith P A

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

What Is Inheritance Tax Probate Advance

The 2018 Estate Tax Rules And Why They May Not Matter The Motley Fool

Estate Tax Exemption 2021 Amount Goes Up Union Bank

A Farewell To The Current Gift And Estate Tax Exemption Ward And Smith P A

How Do State Estate And Inheritance Taxes Work Tax Policy Center

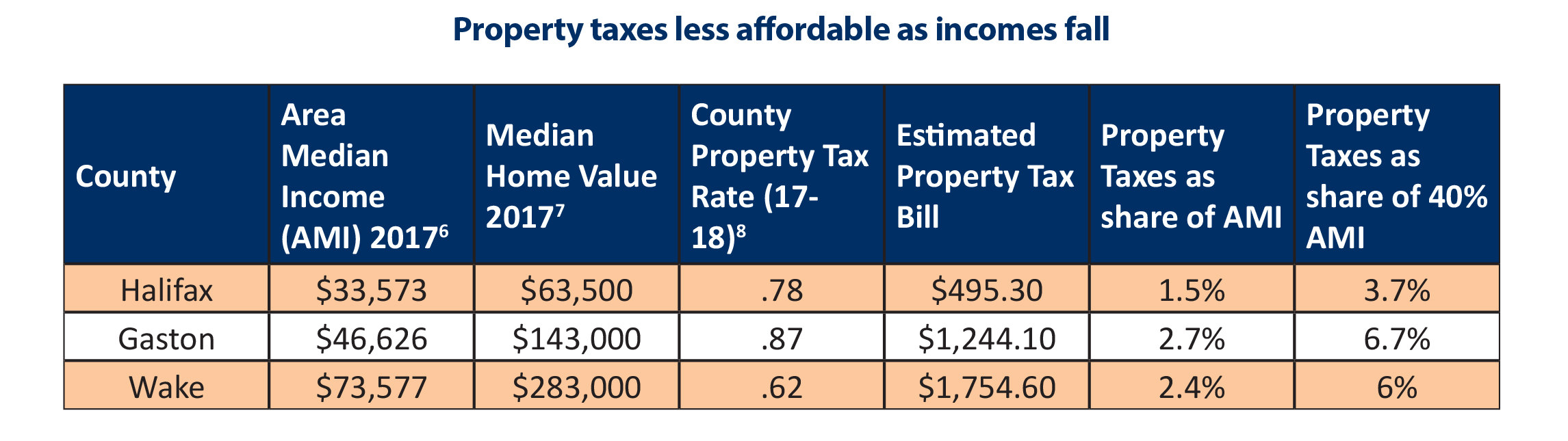

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc():gifv()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)